Secure your child's

future with our Million

Dollar Baby plan

Design a valuable tax advantaged plan that offers the

potential for cash value growth, lifelong insurability, and freedom

to choose how you want to utilize your own account.

Give your children a head start in life with

their financial well-being in mind.

BENEFITS

The Benefits of a Million Dollar Baby Policy

Tax Advantaged Growth

The cash value may grow tax deferred which may allow it grow faster than traditional savings account.

Lifelong Protection

Now you can secure your child's insurability at a young age. Your child's health changes will not affect coverage.

College Planning

Your child may use the cash value in the account to pay for college expenses. This account has more flexibility than a 529 savings account.

Home Purchase

Your child may access accounts cash value to put a down payment for a home purchase.

Retirement Income

Use your accumulated cash value to provide a retirement income stream.

Living Benefits

Policy may be utilized in the event of a critical illness or a qualified disability.

Protection For Life

Insure your children now while they are illness free and can

qualify easily due to no current existing health conditions.

College planning element

529 vs Million Dollar Baby Plan

529

Can only be used for approved education expenses

Can affect eligibility for FAFSA

Exposed to market volatility

Contribution limits

Million dollar baby

Flexibility of use

Does not affect your FAFSA eligibility

No market loss

Stays with child for life

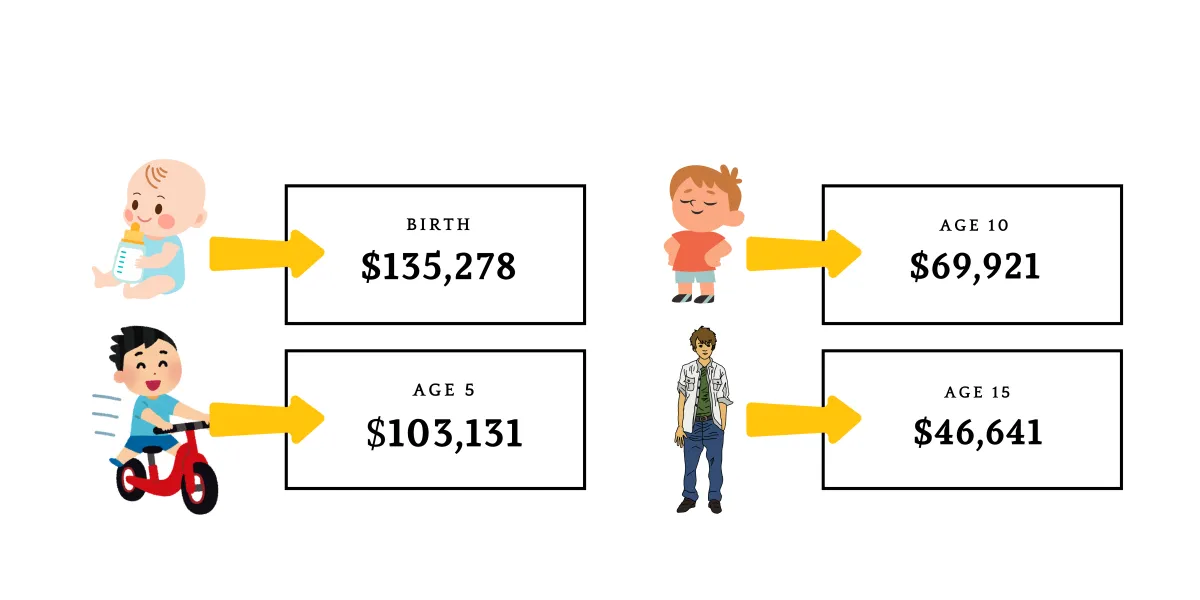

Retirement planning element

Potential Retirement Income

potential annual TAX-FREE retirement access according to the age the account is set up

Access to retirement distributions at age 65

Annual contribution of $2,400

Assuming a conservative 6% interest rate per year

The values represented are ballpark figures, actual performance will vary

Please connect with our team of knowledgeable licensed professionals ready to design a powerful financial strategy for your child.

Call Now

+1214-505-2188

Our Agents are ready to help you secure your child's future.

Setting a child up for success is one of the superpowers we possess. We love creating financially aware and prepared families.

Frequently Asked Question

How early should parents contribute to this plan?

For this type of plan the earlier the better. Parents can set this policy up for children as young as 2 weeks old.

The younger the child is the more time they have to fully enjoy the benefit of compound interest.

How much is my monthly payment?

You may start this policy off with as little as $50 a month. In order to design a more robust plan we recommend $150-$250 a month.

Can my child use this policy for college?

The cash value in this account can accumulate better than any savings account or 529 plan. Also, if they decide against attending college, they can access cash value as a policy loan for the purchase of cars, homes, retirement or to access a lump to use as needed.

Is this account directly investing in the stock market?

No, this is account does not directly invest into the stock market. It is only tied to performance of the S&P 500.

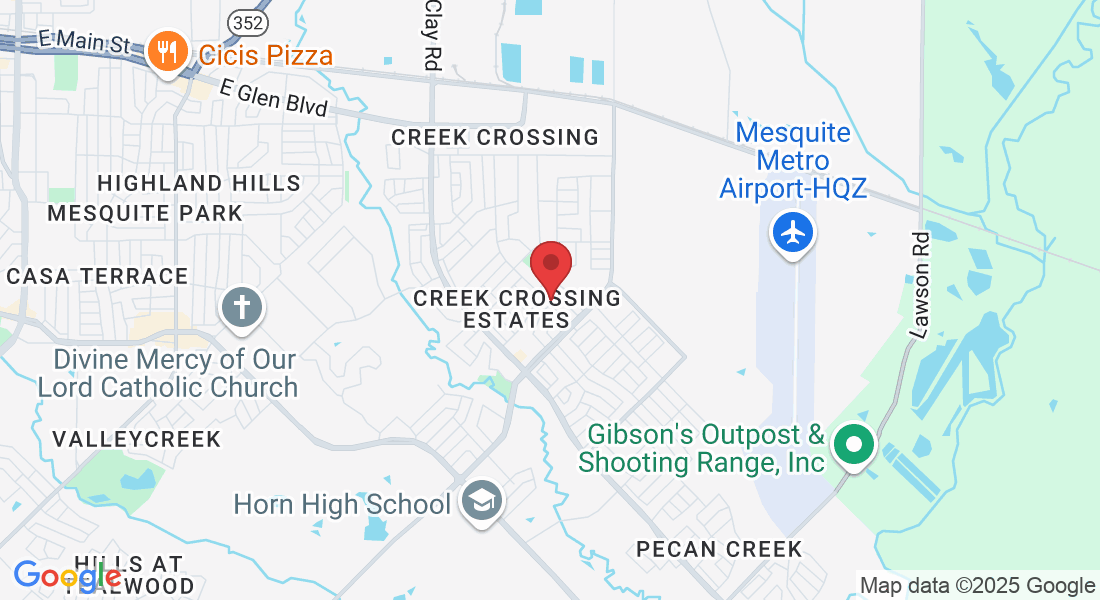

Get In Touch

Email: [email protected]

Address

1616 Creek Valley Rd 249 Texas Mesquite 75181

Phone Number:

(214) 505-2188